In order to make money over time, one needs to assume at least some risk. The more risk a person takes, the more potential there is for greater return. But also along with that comes the risk of loss in the shorter term. One should only take as much risk as they can withstand without getting to the point of feeling investments must be sold when they have declined. This could cause significant harm.

To help in this assessment, click Your Risk Profile and answer the five questions.

PLEASE, PLEASE, PLEASE, before answering each specific question, read the information and view the charts that pertains to that question below…

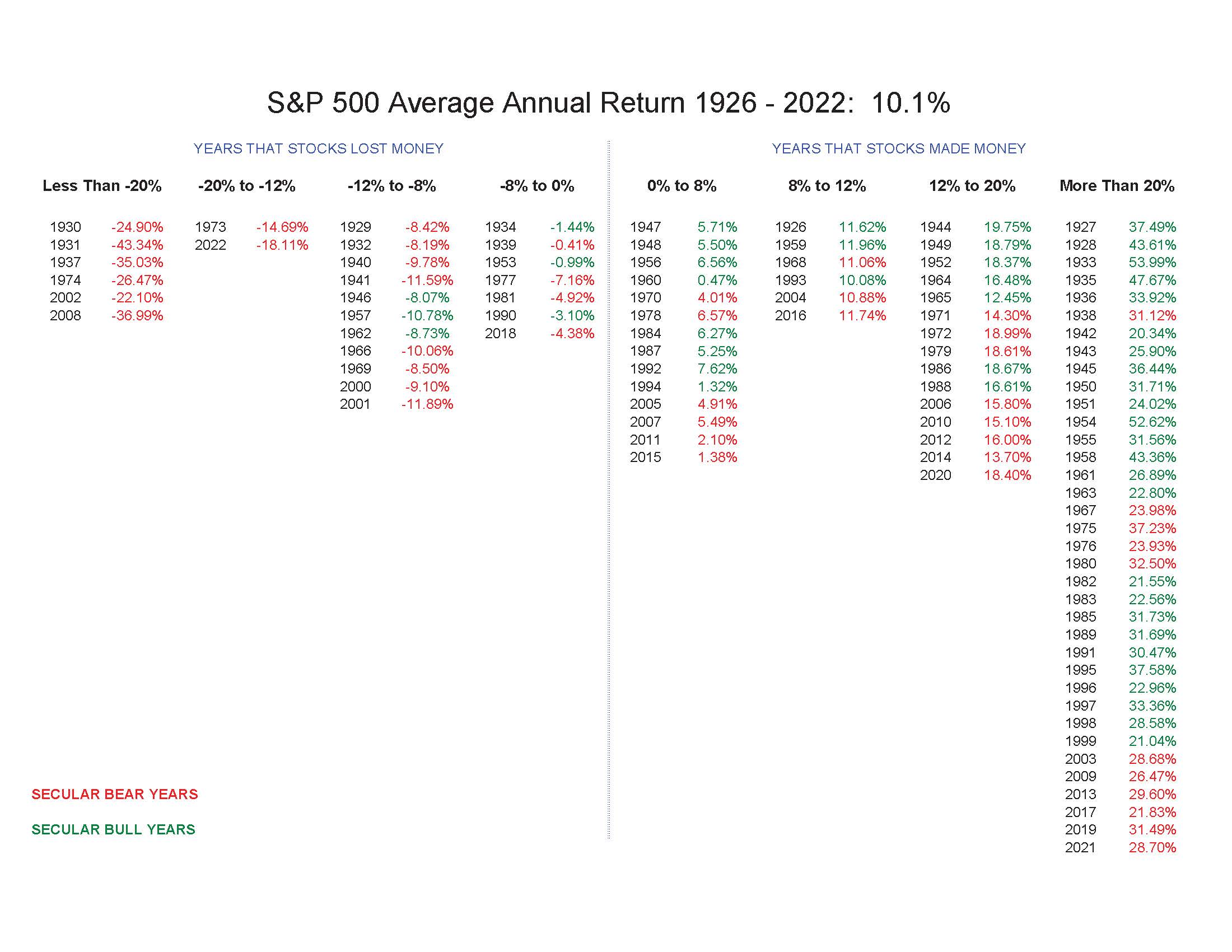

Question 1… These are typical ranges of returns one should expect to experience most the time and not the best and the worst each risk profile could be. There are outliers on the upside and downside. The risk profile all the way on the right is a 100% stock portfolio, and as you go left there is progressive less in stocks. For the 100% stock portfolio, the chart below shows that there are rate of return outliers on the left (larger than typical losses) and right column (larger than typical gains), and you can also see that there are significantly many more years that stocks are up than down and that therefore by being willing to take more risk there is the potential of making more in your portfolio. But you must be comfortable with the typical ranges of returns.

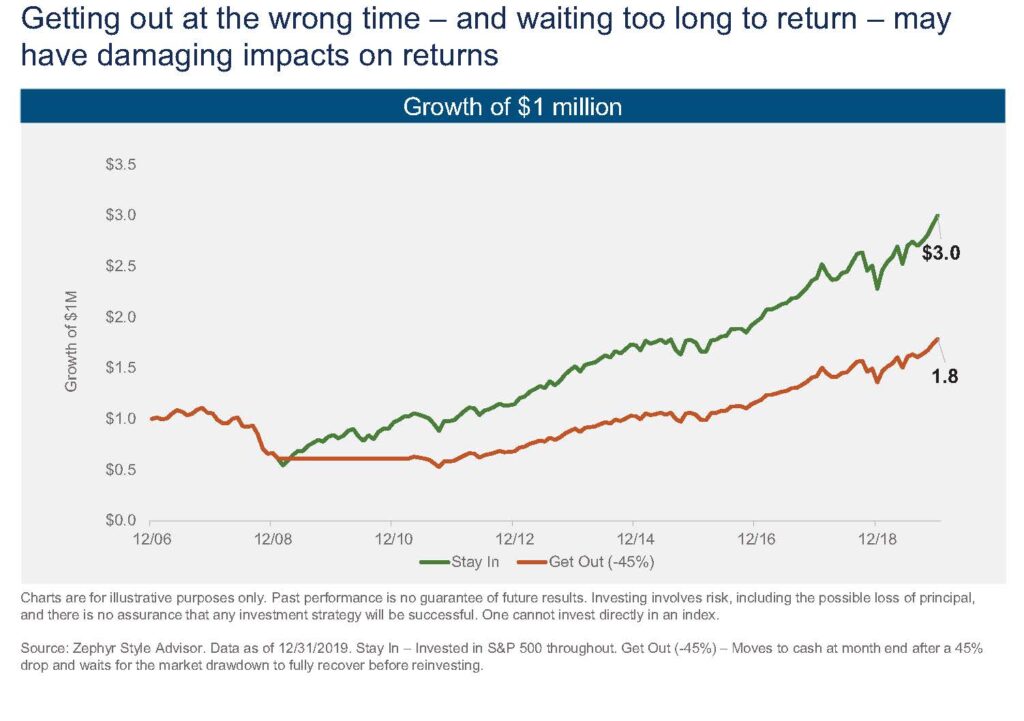

Question 2… This takes out the one year timeframe and looks at maximum declines, including infrequent outliers. Whether 2020 when stocks were down over 30% in a few weeks or November 2007 through early March 2009 when stocks were down over 55% (the worst decline since the Great Depression), how much loss could you experience before you felt you had to take your money out of stocks, even if you were counselled that it was not wise to do so? Below you see the example of two investors, one who did not sell, the green line, and one, the orange line, who sold stocks in in early 2009 because they could not tolerate the size of the market decline and then got back into the market later. The green line investor ended up with much more. This question is to help devise a portfolio that would hopefully not reach the point where you would become the orange line investor. If you would not sell no matter what if counselled not to sell, for this question choose the answer all the way to the right.

Question 3… This is less about your expertise and more about your feelings toward the stock market, so don’t worry if you don’t know for sure what the market will do.

Question 5… Please note that there has to be a definitive plan to take out at least 1/3 of your portfolio for something OTHER THAN retirement spending for you to put any other answer than NEVER.