In their weekly market recap this week, JP Morgan, one of the Portfolio Strategists we utilize for client accounts, discusses the whys behind the recent stellar returns gold has seen and whether gold is a good long term investment…

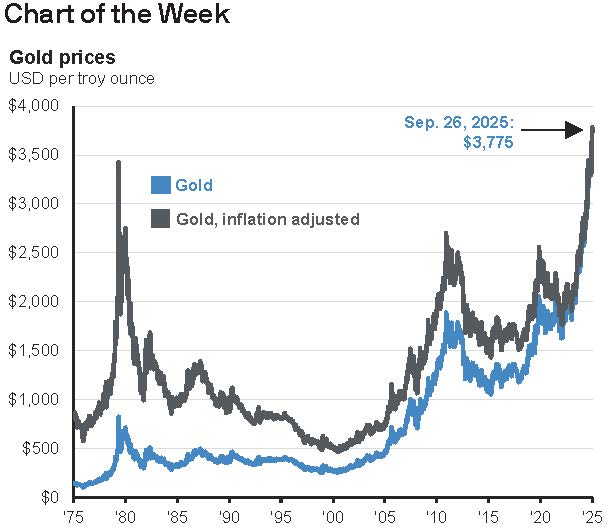

Gold prices have surged to record highs in recent years, appreciating over 40% year-to-date to $3,775 per troy ounce. Last year, gold rose 27%, outperforming the S&P’s total return. While gold demand in volume terms rose just 3% in the second quarter 2025, it has skyrocketed 45% in value terms, according to the World Gold Council, largely driven by central bank buying activity.

Central bank accumulation of gold has been motivated by a desire to diversify reserves, a trend that accelerated in 2022 after the freezing of Russia’s foreign assets. In response, countries turned to gold as a hedge to geopolitical risks and sanctions, rather than for return optimization. More recently, concerns regarding global trade policy, the independence of the Federal Reserve and rising debt burdens in the U.S. and Europe have prompted a shift away from treasury holdings and the dollar, favoring gold instead. While the second quarter 2025 saw the lowest central bank demand for gold since the second quarter 2022, overall demand increased, including investment in gold bars. While these factors have caused the negative relationship between interest rates and gold prices to weaken, recent market optimism for Fed rate cuts has acted as another tailwind to the precious metal. Private investors are offsetting reduced demand from central banks, with gold ETFs seeing their largest inflows in more than 3 years on Sept. 19.

Despite its rally, gold historically hasn’t been a great source of long-term return. As seen in this week’s chart, the inflation-adjusted value of gold today matches its peak 45 years, far underperforming stocks and bonds. Gold’s real value generally keeps pace with inflation, but it lacks earnings or income to fall back on if its value declines. Investors should consider more sophisticated alternatives, like transport and infrastructure, which can both reduce portfolio risk and provide yield.