Inflation has been falling, unemployment has been steady, and the stock market has been rising. What will the Fed do, and what does that mean for the investment markets? JP Morgan, one of the Portfolio Strategists we utilize for client accounts, wrote the following in their Weekly Market Recap today..

In recent weeks, markets absorbed a lot of news pertaining to both sides of the Fed’s mandate, full employment and inflation. In June, payroll job growth declined, the unemployment rate ticked down from 3.7% to 3.6% and wage growth remained at 4.4% year over year, neither adding to, nor diminishing, fears of wage inflation. Meanwhile, June retail sales data added to a picture of a resilient economy, which we expect to be confirmed by this week’s second quarter GDP release. The other part of the Fed’s mandate, inflation, continues to decelerate, with June headline and core CPI at 3.0% and 4.8% year over year, respectively. Similarly, Powell’s preferred measure, super-core inflation, fell to its lowest level since September 2021. While both parts of the Fed’s mandate continue to trend in the right direction, we expect the Fed to hike another 25bps on Wednesday. The market clearly agrees and is pricing in a 96% probability of a hike.

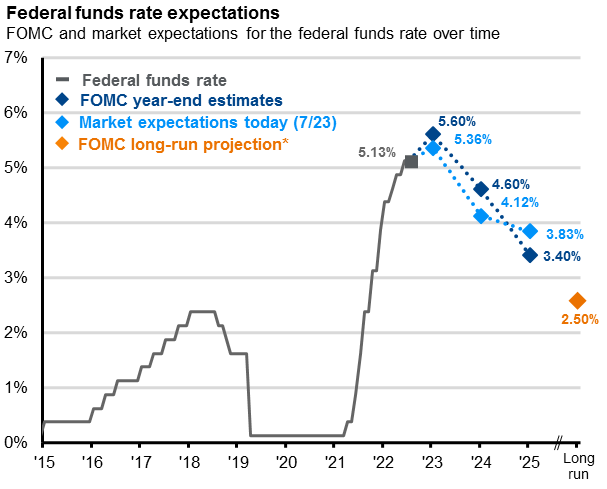

Regardless, the end of the Fed hiking cycle looks closer than it did earlier this year, with this week’s chart showing the market expects no further hikes for the remainder of the year assuming we get a hike Wednesday. However, the market appears too pessimistic in its outlook for rate cuts with only one full cut expected in the first quarter 2024 and a cumulative 1.25 % for the year. The Fed often raises rates on an escalator, before being forced to take an elevator down, with rates falling on average 2.75% within the first year of cuts. As rates move lower, the investment climate becomes more appealing for all long-term asset classes. Investors may want to extend fixed income duration as expectations for policy rates in 2024 and 2025 may be too high given a softening in growth momentum and rapid decline in inflation.