Many investors have asked me over the years about investing in gold. The answer to that question is not simple, but in today’s Weekly Market Recap, JP Morgan, one of the Portfolio Strategists we utilize for client accounts, wrote some pertinent comments about gold…

Last week, gold prices broke above $2,300 per ounce for the first time ever. Gold prices have been climbing for a number of reasons, among which may be more hope for a soft landing and upcoming rate cuts in the U.S. This is because the opportunity cost of investing in gold, which is not an income-producing asset, decreases when interest rates fall. Recent dovish messaging from the Fed has

increased investor demand for gold ahead of expected rate cuts this summer. Also, gold may be attracting investors concerned about ongoing global conflicts, as it is widely considered a safe-haven asset. Lastly, China’s real estate crisis has pushed more domestic investors toward gold.

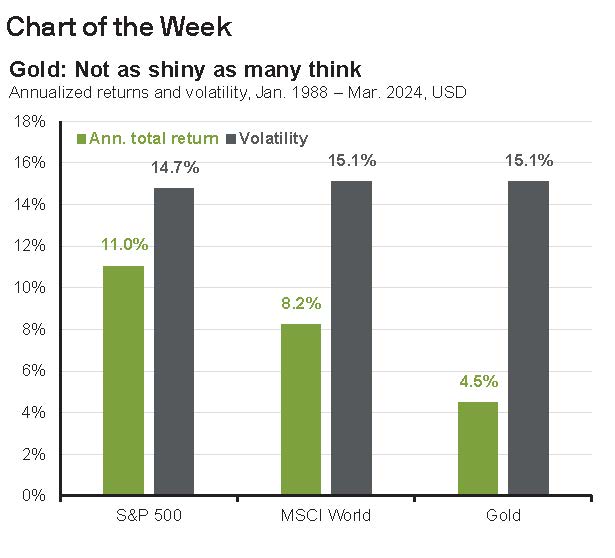

Should long-term investors buy gold? This week’s chart shows that over the past 46 years, gold has had worse performance and similar volatility compared to both U.S. and developed market equities. Unlike equities that are anchored by earnings or bonds that pay coupons, gold and other precious metals are largely determined by speculation on where prices are headed. Therefore, precious metals are inherently amore tactical asset class, with limited utility in long-term portfolios. It is still important to understand the driving forces behind gold and other commodity prices to gauge investor sentiment and broader market trends. However, for investors looking to hedge risk and diversify, focusing on quality fixed income, equities and more fundamentally based alternatives may be a better strategy.