The Fed has raised rates quite a bit to help curb demand in the economy hoping that less demand for goods and services would bring prices down. As the following weekly update from JP Morgan, one of the Portfolio Strategists we utilize for client accounts, inflation has been falling while consumer spending has been strong…

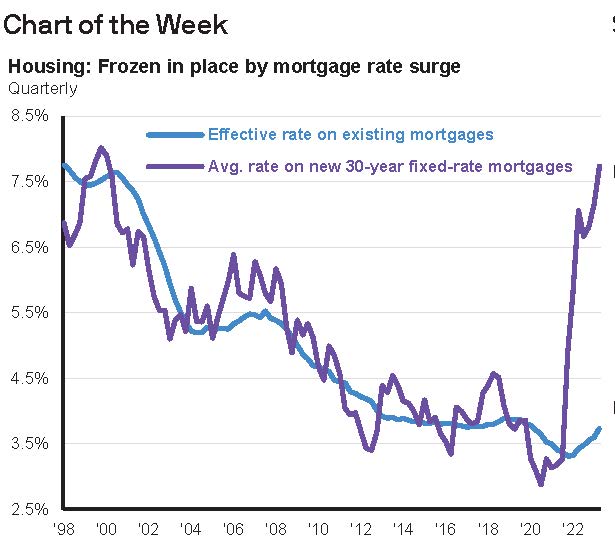

Despite a decline over the past few weeks, the 30-year fixed rate mortgage rate remains at nearly its highest level in 20 years and more than double its level at the start of last year. However, it is important to distinguish between the impact of this rate surge on the housing market and on consumption. This week’s chart shows the yawning gap between the average rate on new 30-year fixed-rate mortgages and the average mortgage rate for existing mortgage holders. For home buyers, the change in the environment has been dramatic, leading to a very sharp decline in both housing starts and home sales. However, it is important to recognize that fewer than 4% of American households bought a home in the last year. For the vast majority of families who either don’t have a mortgage or have a fixed-rate mortgage, the surge in mortgage rates has had no impact on their financial position. For this reason, while the Federal Reserve has been raising interest rates to slow aggregate demand, real consumer spending has remained strong, with a 2.2% year over-year increase in October and a strong early start to the holiday retail season. In short, while the Fed’s higher-for longer interest rate policy continues to undermine the housing market, it is having little impact on consumer spending and today’s housing crunch, unlike the bursting housing bust of the mid-2000s, and does not appear to be of a magnitude that will put the U.S. economy into a recession.