After underperforming the US stock market since 2009, international stocks have roared back this year to outperform US stocks for US investors. In this week’s Weekly Market Recap, JP Morgan, one of the Portfolio Strategists we utilize for client accounts, wrote the following to explain what is behind this phenomena and whether this may continue…

The last two weeks were big ones for monetary policy, with five major central banks announcing their interest rate decisions and signaling the direction of travel. The Fed and Bank of Canada cut rates by .25%, while the European Central Bank, Bank of England and Bank of Japan stayed on hold. For investors, these moves matter not just for their implications for the bond market but also for how diverging policy paths affect currencies, and, in turn, shape global portfolio returns.

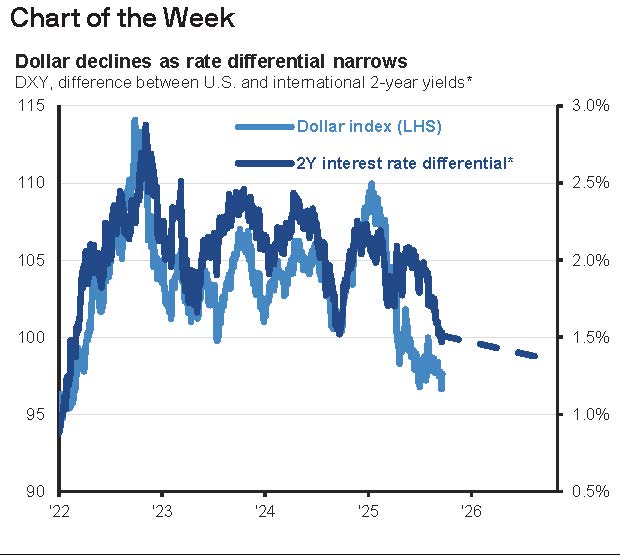

Year-to-date, U.S. and European equities have posted nearly identical gains in local currency terms, but the picture looks wildly different when measured in dollar terms, with Europe up more than twice as much as the U.S., helped by a roughly 10% decline in the greenback. While several factors have weighed on the dollar index, its moves have closely followed shifts in the 2 Year interest rate differential, as shown in this week’s chart. In fact, over a third of the dollar’s decline this year can be attributed to the narrowing in this spread. That makes sense because the 2 Year tends to reflect where policy is headed, not just where it is today, in turn dictating the relative demand for the currency.

Looking ahead, as the chart’s dashed line shows, the swaps market suggests the 2 Year differential will compress further, as the Fed is expected to continue easing while many peers have already reached close to their neutral. Moreover, with the U.S. administration’s explicit preference for a weaker dollar, the outlook for further softness gains traction. For investors, this, along with improving fundamentals overseas, reinforces the already strong case for international diversification, particularly as portfolios remain heavily tilted toward the U.S.